What do you call someone that saves, budgets, and invests your money for you? Most would call that a ‘financial planner’ but we call it Digit. Let’s check out this week’s startup, the all-in-one money app for the regular person.

⚾ The Elevator Pitch

Do you ever get a feeling that no matter how hard you try, you’re still not saving enough money? Well, for starters you could spend less, but life always gets in the way. Maybe your car needs new tires or your house needs a new roof - And just like that, saving can take a back seat.

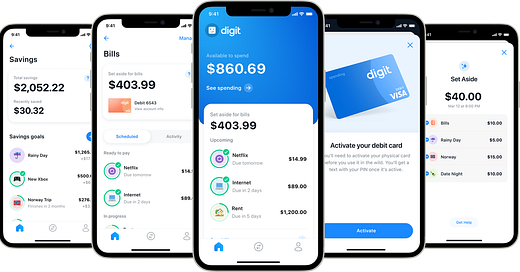

While you can’t control the economy, you do have control of the financial actions you take. Compliments to Digit, you can now stress less about your money management. Digit helps you reach your financial goals by automatically making smart financial decisions and recommendations for you every day. From paying your Netflix subscription to reaching your goals - It’s a one-stop solution to Spend, Budget, Save, and Invest.

👇 The Drop Down

Site: https://digit.co/

Founded: 2013

Stage: Series C

Tech trend: FinTech

Traction: Acquired by Oportun for $221.1 million, helped users save more than $7 billion, offers $500K in SIPC protection, Launched Digit Visa Debit card, Featured on Business Insider, GlobalNewsWire, and TechCrunch.

Team: Financial Advisor, Strategy maker, and entrepreneur.

Ethan Bloch (CEO) | Rushabh Doshi (COP) | Michael Murray (CTO)

🔍 Why we like it

🏎️ Digit wants to make your life stress less

Digit’s goal is simple: help people stress less about money while building them a stronger financial future. About 70% of the young American population is financially “unhealthy” — an average student loan is $37K, one in five has zero retirement savings, and the nation's credit card debt has reached $1 Trillion. Digit wants to break these financial hurdles using technology to make sure everyone is spending, investing, and saving wisely for their futures.

📈 Using advanced automation…Digit helped save Billions $$$

Digit knows that people do not want extra work thrust upon their already busy lives so they built systems that automatically craft smart financial decisions for their users - more or less what a financial advisor would do manually. Their automated algorithm is smart and predicts day-to-day spending, assesses pattern, and does whatever is necessary to help you save those extra bucks. They have already saved their users over $7 billion collectively!👫They are expanding to a complete neobanking experience

In a few short years, Digit is expected to become the digital financial advisor now that it is acquired by Oportun – a thriving company that also offers financial services.