Today, inflation is at an all time high, the federal interest rates are skyrocketing, and investors across the United States are panicking about their investments. This week’s startup, Masterworks, offers investors an alternative investing strategy to hedge against the markets - fine art.

👋🏽 Check out Masterworks today!

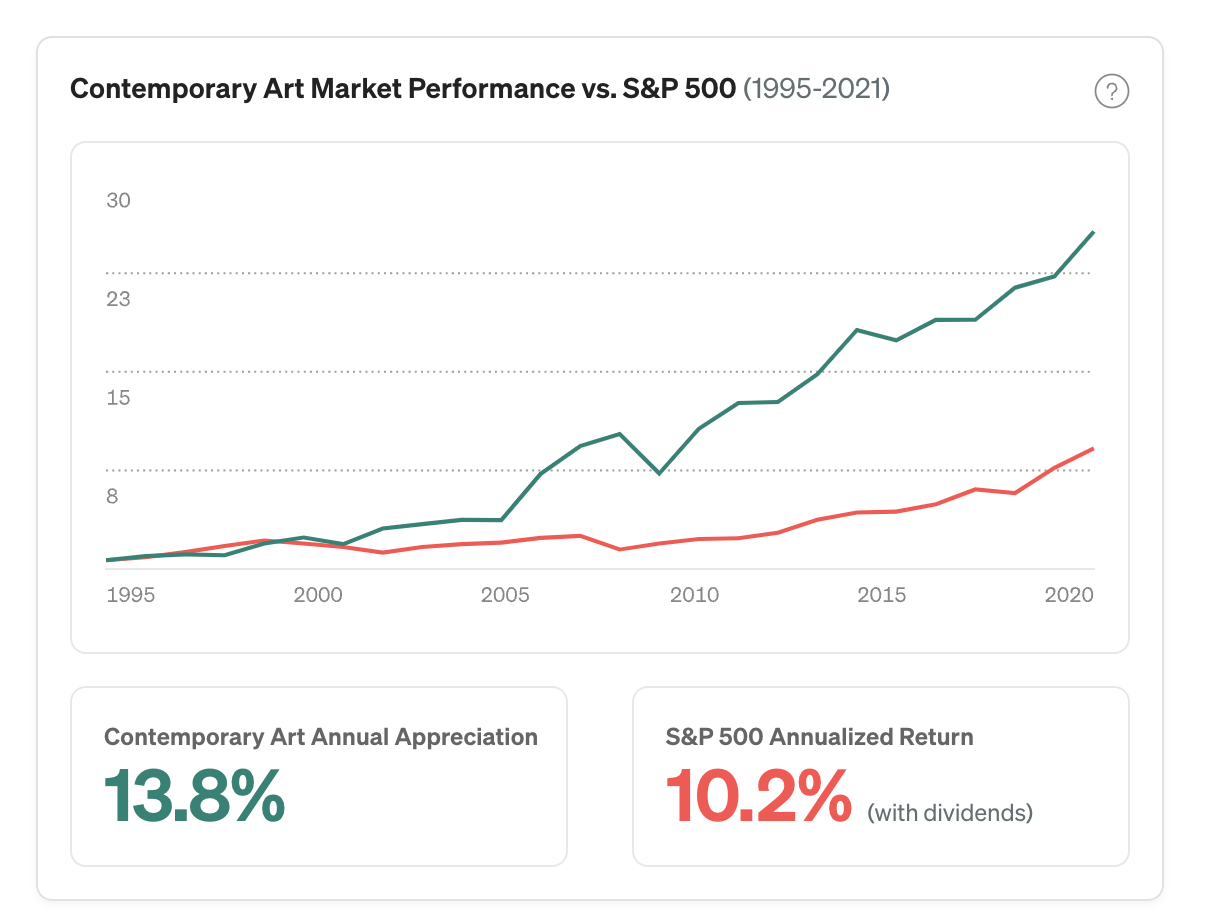

What happens when cutting-edge analysis meets one of the world’s oldest markets? An undeniable investing edge. Masterworks is the one investing platform enabling investors to acquire shares of contemporary art, a category that has outpaced the S&P more than 2x from 1995–2021.

⚾ The Elevator Pitch:

Masterworks is the first platform for transacting shares that represent investments in iconic artworks. They give investors the opportunity to build a diversified portfolio of expertly-vetted art works curated by industry-leading research teams. Masterworks deals with the hard parts of art investing like curating artists, upfronting costs for expensive pieces, building security around the artwork, and the logistics around maintaining the piece. For the average Masterworks user, they just need to deal with an app.

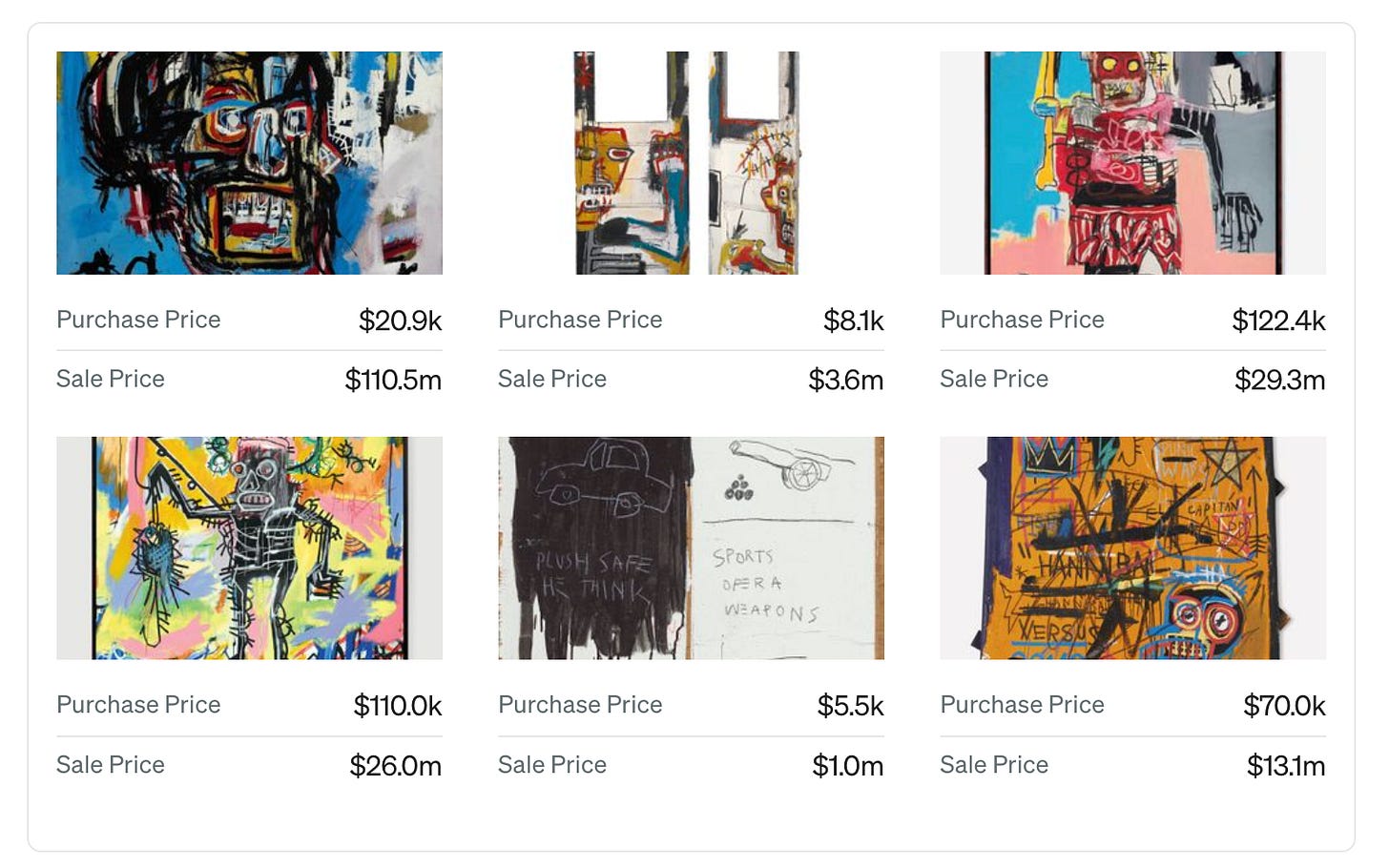

Masterworks has already purchased and sold securities for numerous pieces like Banky’s Mona Lisa, Jean-Michel Basquiat’s The Mosque, and more. They’ve also released numerous features like secondary market trading and appreciation proejctions. Best of all, they’re already delivering impressive returns to investors: 4 exits, each at a compound annual growth rate of more than 30%

👇 The Drop Down

Site: https://www.masterworks.io/

Founded: 2017

Trend: Alternative investing

Traction: 450k+ users, $500M+ in art value, over 100+ different SEC-qualified offerings available for investment, 14.3% net annualized yield track record

Backing: $110 million Series A, $1 billion+ valuation

Team: Internet entrepreneurs, art experts, economics veterans

Scott Lynn - Founder and CEO

Masha Golovina - Director of Acquisitions

Nigel Glenday - Chief Financial Officer

Allen Sukholitsky - CFA Chief Investment Officer

🔍 Why we like it

⚡️ A natural market hedge

With more folks than ever looking to diversify their portfolios, art offers an attractive hedge in today’s volatile markets. Historically, it has maintained near-zero correlations to public markets, and in the last stagflationary period, art saw annual appreciation of more than 33%, beating out both gold and real estate.🎨 Curating (only) the best

Masterworks employs entire research teams to ensure that their holdings are the best of the best. They have digitized over 75 years of auction data and can predict price projections, with high accuracy, to help guide prospective investors.🌊 Liquidity is a concern, but not more

Historically, one of the biggest concerns with art holdings was their illiquid nature. But with their Secondary Market, investors can now part with shares of their investments by selling it to other investors - this wasn’t possible before!

🤝 Get involved with Masterworks

Sign up today on their website!

Check out their catalog and make an art purchase today!